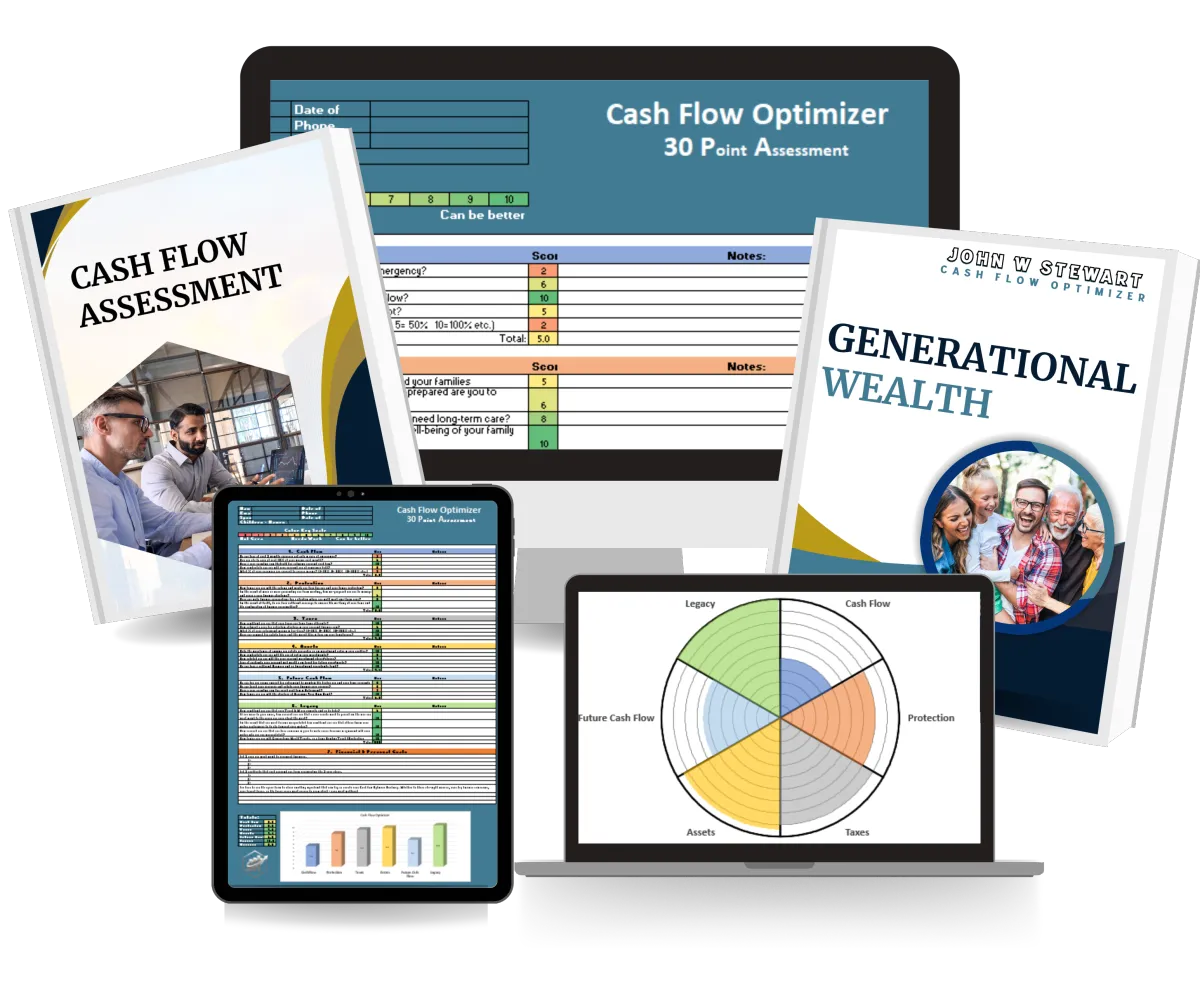

The Cash Flow Optimizer

30 Point Assessment

This assessment is designed to evaluate your strengths and weaknesses across six key financial categories and assists you in defining your financial and personal goals.

The Cash Flow Optimizer

30 Point Assessment

This assessment is designed to evaluate your strengths and weaknesses across six key financial categories and assists you in defining your financial and personal goals.

Evaluate 6 Key Aspects of Your Financial Status:

Current Cash Flow

Protection

Tax Efficiency

Future Cash Flow

Assets

Legacy Strategy

Current Cash Flow

Struggling to maximize your cash flow effectively is a common challenge faced by many individuals and businesses alike that affects financial stability and planning capabilities.

Find out how much of your current income you could be saving/investing

Increase the percent of your expenses that are covered by passive income

Create a roadmap to reducing your current level of consumer debt

Protection

Do you wonder if you and your family are protected from unexpected life events? It is important to gauge your awareness, preparedness, and provisions for unforeseen circumstances and future financial security.

Understand the options for yours and your family's financial protection

Make financial preparations for the event of illness or injury preventing you from working

Ensure sufficient coverage for the well-being of your family and the continuation of financial responsibilities

Tax Efficiency

A cornerstone of our financial strategy is evaluating your confidence and preparedness in various aspects of tax planning and identify potential areas for improvement.

Create a strategy that includes efficient tax planning

Build tax-free retirement assets

Plan for estate taxes and how they will impact your beneficiaries

Assets

Your current assets serve as the cornerstone for building future wealth and financial security. Whether they are savings, investments, real estate, or business holdings, these assets provide the initial capital and resources needed to pursue further financial growth.

Establish an Opportunity Fund with guaranteed growth.

Reduce risk in your investment portfolio

Enjoy confidence that your current net worth is on track for future goals and needs.

Future Cash Flow

Evaluating your financial strategy includes determining if your current savings are enough to sustain your family's lifestyle, regularly tracking and updating your financial goals, and having a clear plan for managing asset cash flow in retirement.

Create a clear spending plan for asset cash flow in retirement

Feel confident that you are saving enough to maintain the lifestyle you enjoy

Track your progress and update your financial goals regularly

Legacy Strategy

Create a legacy that leaves a lasting impact on future generations and supports the causes that matter most to you. By carefully planning and allocating your resources, you can ensure that your wealth, values, and principles are passed down.

Ensure your assets are passed on to the people and causes you care about most

Rest assured that you have someone in place to make crucial decisions if you were incapacitated

Learn and understand what a Generational Family Banking Trust is